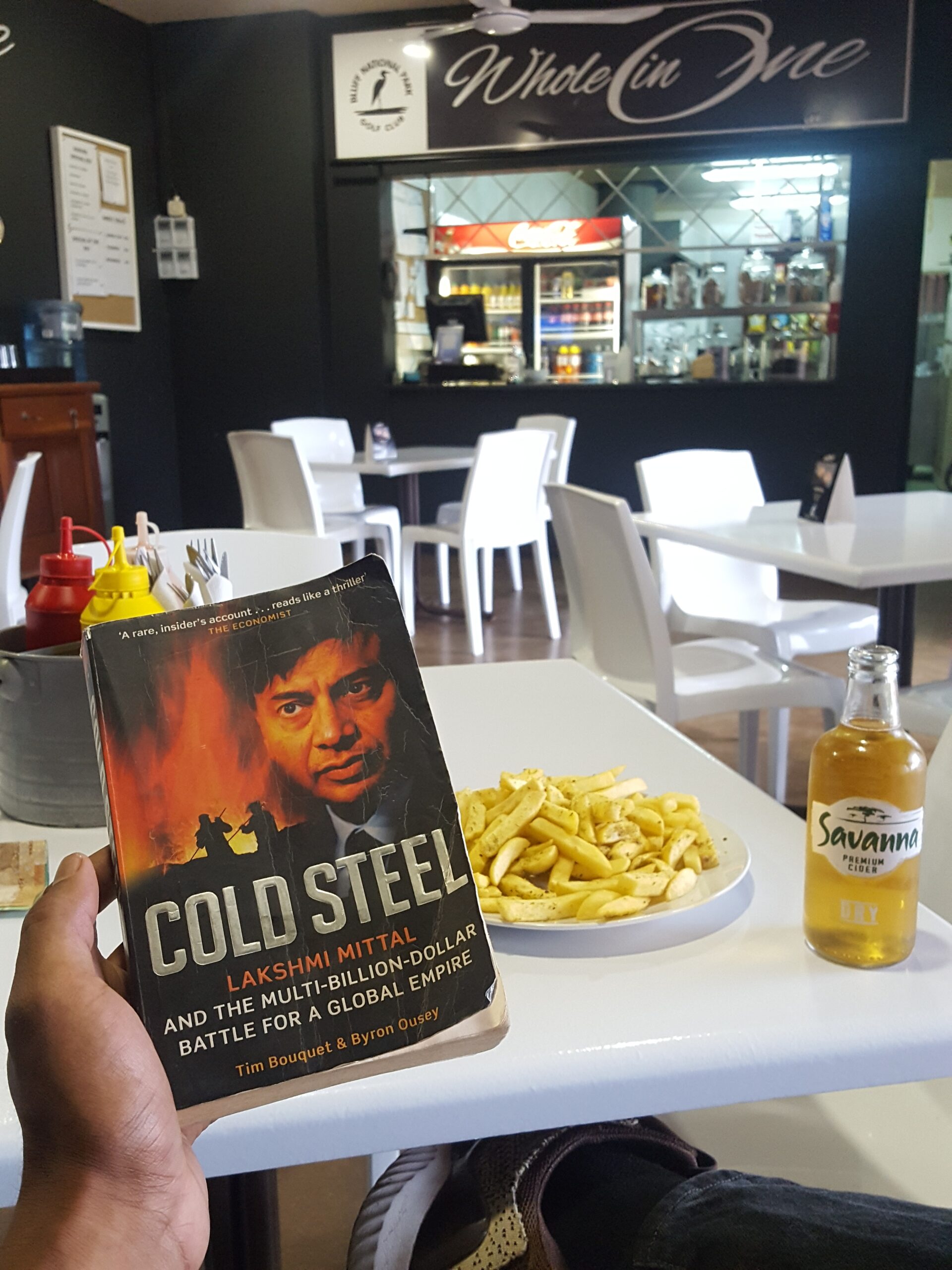

Unveiling the Genius of Lakshmi Mittal: My Journey Through Cold Steel by Tim Bouquet and Byron Ousey

Reading Cold Steel: Lakshmi Mittal and the Multi-Billion Dollar Battle for a Global Empire by Tim Bouquet and Byron Ousey was a transformative experience for me. I first picked up this book in 2014 and was enamored with its intricate details and captivating narrative. It opened my eyes to the fascinating world of deal-making in an industry that most of us take for granted—steel. Lakshmi Mittal, the man at the center of this story, is one of the most underrated billionaires in the world, and this book brilliantly showcases his keen eye for deals and his relentless drive to build a global empire.

The Underrated Billionaire: Lakshmi Mittal

From the very beginning, it’s clear that Lakshmi Mittal is no ordinary businessman. His ability to see opportunities where others see obstacles, and his tenacity in getting deals done no matter the circumstances, is nothing short of remarkable. In my opinion, Mittal is the Bill Gates of the steel industry—an innovator who revolutionized the sector and built an empire that spans the globe. The book is almost written like a novel, making it impossible to put down. I was captivated from the first page, and as I delved deeper into Mittal’s life and career, I found myself increasingly inspired by his quiet yet calculating demeanor. On the surface, he might appear reserved, but underneath lies a mind that is constantly at work, strategizing and calculating the next big move—something I can deeply relate to.

The World of Steel Manufacturing

Before diving into the intricacies of Mittal’s business deals, the authors take the time to familiarize readers with the steel manufacturing process. This is not just a backdrop; it’s essential to understanding the magnitude of Mittal’s achievements. Terms like the amount of carbon (coke), the ductility of steel, and the complexities of steel production are introduced, providing a solid foundation for the reader.

The book also delves into different types of steel manufacturing, such as Bessemer steel—a process that revolutionized the industry by making steel production more efficient and cost-effective. The authors explore the history of steelmaking across different geographies, highlighting how regional practices and resources shaped the development of the industry. For instance, European countries like the UK and Germany were pioneers in the Bessemer process, while the US developed its own variations as it industrialized. Understanding these regional differences and historical contexts adds depth to the narrative, making Mittal’s achievements even more impressive.

As someone who had little knowledge of this industry, I found this introduction fascinating. It’s easy to overlook the importance of steel in our daily lives, but this book made me appreciate the industry’s vital role in the global economy.

The Art of Deal-Making

What truly sets Cold Steel apart is its detailed account of Mittal’s strategic acquisitions. The authors systematically go through deal after deal, highlighting the financial wizardry involved in mergers and acquisitions (M&A). Mittal’s aggressive approach to bidding on steel companies, often through hostile takeovers, is a testament to his ambition and drive. The book hints at the complex financial maneuvers that M&A specialists in the banking and finance industry perform, and it’s here that I began to see the true genius of Mittal. His ability to secure financing and navigate the intricate web of global finance is nothing short of extraordinary.

Here are 12 key companies and their respective countries that Mittal acquired, which significantly contributed to the growth of ArcelorMittal:

- Ispat International – India

- Karmet Steel Plant – Kazakhstan

- Unimetal – France

- Sidex – Romania

- Nova Hut – Czech Republic

- BH Steel – Bosnia and Herzegovina

- Iscor Steel – South Africa

- Petrotub – Romania

- Polskie Huty Stali – Poland

- Dofasco – Canada

- Villarreal – Mexico

- Arcelor – Luxembourg (leading to the formation of ArcelorMittal)

These acquisitions were not just about expanding his empire; they were strategic moves that capitalized on market slumps and undervalued assets. Mittal’s aggressive approach, coupled with his ability to see the potential in struggling companies, allowed him to build the world’s largest steel empire.

The Power of Influence

One of the most striking aspects of Mittal’s journey is the sheer power he wielded as he acquired companies. In one instance, he described the acquisition of a company with 27,000 employees as akin to buying a whole city. The responsibility that came with these acquisitions was immense—entire communities depended on the operations of these companies. It was a stark reminder of the far-reaching impact of business decisions and the power that comes with such responsibility. As someone who has always admired success and sought to understand what sets successful people apart, this was a powerful insight.

The South African Connection

As a South African, the story of how Mittal acquired Iscor’s steel plants hits close to home. South Africa has had its share of corrupt politicians, and Mittal’s acquisition of Iscor was a masterstroke—what many would call a “steel of a price.” While it was a great deal for Mittal, it also symbolized a significant loss for South Africa. It was a reminder of the complexities of global business and how strategic thinking can sometimes result in one side gaining more than the other. This acquisition resonated deeply with me, highlighting the brilliance and the ruthlessness that can accompany such deals.

The Tenge Currency Deal: A Creative Solution to a Complex Problem

One of the most fascinating stories in the book involves Mittal’s acquisition of the Karmet Steel Plant in Kazakhstan. Kazakhstan’s currency, the tenge, was relatively new and fragile at the time of the deal. The country was wary of large currency transactions that could destabilize the economy by spiking inflation or creating financial imbalances. This presented a unique challenge for Mittal, who needed to honor his financial commitments without causing economic disruption.

Mittal, ever the creative problem-solver, came up with an unconventional solution. Instead of transferring large sums of money through traditional banking channels, which could have negatively impacted the tenge, he decided to bring the money into Kazakhstan in cash—literally. He had to suitcase cash into the country to ensure the deal went through smoothly. This approach not only allowed him to honor his deal but also prevented any adverse effects on the Kazakh economy.

This story highlights the level of complexity and the kinds of challenges that come with operating on a global scale. It’s a situation that most of us will never encounter, but it gives insight into the real-world problems that international business leaders like Mittal must navigate. It also made me think about the broader implications of such actions, including the role of central banks and the delicate balance required to maintain economic stability in emerging markets.

The Creativity and Drive of Lakshmi Mittal

What truly fascinated me about Mittal was his creativity and drive. The book is filled with stories that showcase his ability to think outside the box. The tenge currency deal is just one example of his resourcefulness and determination to get things done, no matter the obstacles. This kind of problem-solving ability is rare and is a key reason why Mittal was able to build such a successful global empire. It’s moments like these that made me ponder the bigger issues that companies and governments face—issues that often remain hidden from the public eye.

The Man Behind the Empire

Beyond the deals and the acquisitions, Cold Steel offers a glimpse into the personality of Lakshmi Mittal. Despite his immense wealth and success, Mittal is described as a frugal man who lived modestly in India. His grandfather was a broker from Karachi, belonging to the Marwari ethnic group, and Mittal’s childhood was marked by perseverance and diligence. Walking to school, facing hardships, and eventually rising to become one of the most powerful figures in the steel industry is a story of determination and grit. His quiet and calculating exterior hides a mind that is always working, always strategizing—a trait that I find incredibly relatable.

Conclusion: The Brilliance of Lakshmi Mittal

Cold Steel is more than just a book about steel; it’s a testament to the brilliance and hard work of Lakshmi Mittal. His ability to see opportunities where others see obstacles, to think creatively under pressure, and to build an empire from the ground up is nothing short of inspiring. For me, this book was not just an insight into the world of deal-making; it was a reminder of the importance of determination, creativity, and strategic thinking.

As I read about Mittal’s journey, I found myself relating more and more to his character. Like Mittal, I understand the value of quiet calculation, the need to think strategically, and the power of perseverance. Books like Cold Steel have played a crucial role in shaping my understanding of the world and the principles that drive success. For anyone interested in business, finance, or simply understanding the complexities of the global economy, this book is a must-read. It’s a story of brilliance, hard work, and the relentless pursuit of greatness—a story that continues to inspire me in my own journey.